Kegagalan mengemukakan Borang E. With Talenox Payroll you can submit Borang E in just 3 steps.

How To Step By Step Income Tax E Filing Guide Imoney

Lembaga Hasil Dalam Negeri Malaysia tidak bertanggungjawab terhadap sebarang kehilangan atau kerosakan yang dialami kerana menggunakan maklumat.

. --Sila Pilih-- 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 dan sebelum Semua All. EA Form in PDF Download. Management Services and Human Resources Division.

Borang E bagi Tahun Saraan 2016 adalah 31 Mac 2017. WP0218 BORANG E 2017 PERINGATAN PENTING 1 Tarikh akhir pengemukaan borang. B Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 2020 adalah menjadi satu kesalahan di bawah.

3 Amount of zakat OTHER THAN that paid via monthly salary deduction Name CP8D-Pin. Majikan yang aklumat melalui e-Data Praisi tidak perlu mengemukakan Borang CP8D. Home Home.

URUSAN SERI PADUKA BAGINDA BAYARAN POS JELAS POSTAGE PAID PUSAT MEL NASIONAL SHAH ALAM MALAYSIA NO. Export Procedures on The Import DutyTax Exempted Raw Materials and Packaging Materials. Filing e-E pada 1 Mei 2016 Borang E tersebut akan dianggap sebagai lewat diterima mulai 1 April 2016 dan boleh dikenakan kompaun lewat kemukakan borang di bawah perenggan 1201b Akta Cukai.

B Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 2019 adalah menjadi satu kesalahan di bawah. Majikan yang aklumat melalui e-Data Praisi tidak perlu mengemukakan Borang CP8D. Atau b Luar Malaysia tidak melebihi sekali dalam satu tahun kalendar terhad kepada RM3000.

Cannot retrieve contributors at this time. Form E Borang E is required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later than 31 March. One Borang E-ready software you can consider from the list is Talenox.

RETURN ON REMUNERATION FROM EMPLOYMENT CLAIM FOR DEDUCTION AND PARTICULARS OF TAX DEDUCTION UNDER THE INCOME TAX RULES. Talenox is a self-service HR SaaS that helps thousands of companies avoid penalisations and audits by accurately auto-calculating their salaries and taxes for free. How To Use Lhdn E Filing Platform To File Borang E To Lhdn Clpc Group from clpcmy This form is prescribed under section 152 of the income tax act 1967.

65392 employers were fined andor imprisoned for not submitting Borang E in the Year of Assessment 2014. As an employer this will be your responsibility to ensure that the rest of your employees get their forms by the month of February every year. --Sila Pilih-- Semua All Tahun.

Section 83 1A Income Tax Act 1967. Dalam Malaysia termasuk perbelanjaan penginapan dan makanan tidak melebihi 3 kali dalam satu tahun kalendar. Namun demikian bagi terus menggalakkan majikan menggunakan kemudahan e-Filing.

Head over to Payroll Payroll Settings Form E. Borang e 2017_1 1. 31 Mac 2018 a Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 2018 adalah menjadi satu kesalahan di bawah perenggan.

Muat Turun Borang - Majikan Kategori. Selain Syarikat Selain Individu. Employers companys particular Details for ALL employees remuneration matters to be included in the CP8D.

31 Mac 2020 a Borang E hanya akan dianggap lengkap jika CP8D dikemukakan pada atau sebelum 31 Mac 2020. Hasil Dalam Negeri Malaysia LHDNM ialah pada 31 Mac 2016. EA Form in Excel Download.

Essentially its a form of declaration report to inform the IRB LHDN on the number of employees and the list of employees income details and must be submitted by 31st March of each calendar year. The following information are required to fill up the Borang E. Dont be part of this statistic for the new year.

1 Tarikh akhir pengemukaan borang. Jawatan Kosong Kerajaan dan Swasta 2017 menampilkan Jawatan Kosong Lembaga Hasil Dalam Negeri Ogos 2017. 671 lines 518 sloc 27 KB.

31 Mac 2019 a Borang E hanya akan dianggap lengkap jika CP8D dikemukakan pada atau sebelum 31 Mac 2019. Form E Borang E is a form required to be filled and submitted to Inland Revenue Board of Malaysia IBRM or Lembaga Hasil Dalam Negeri LHDN by an employer. Borang E bagi Tahun.

1 Tarikh akhir pengemukaan borang. Hak Cipta Terpelihara 2016 Lembaga Hasil Dalam Negeri Malaysia. As a business in Malaysia youll want to avoid a fine of RM 200 RM 20000 andor a maximum of 6-month imprisonment term under the Income Tax Act Section 1201b.

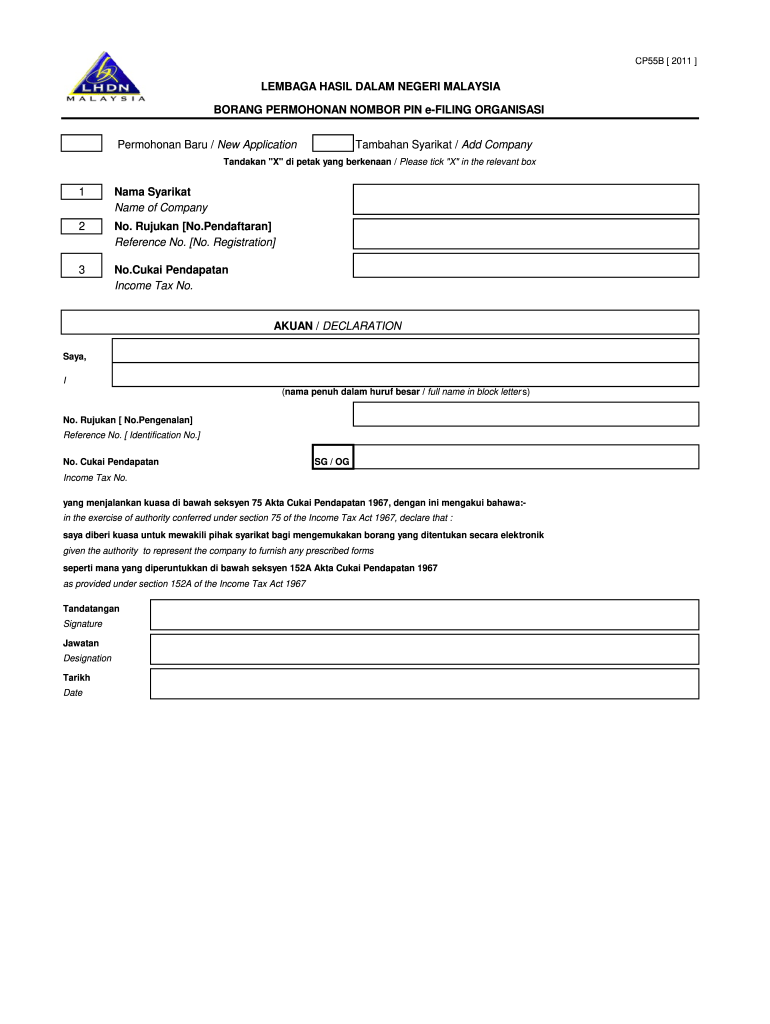

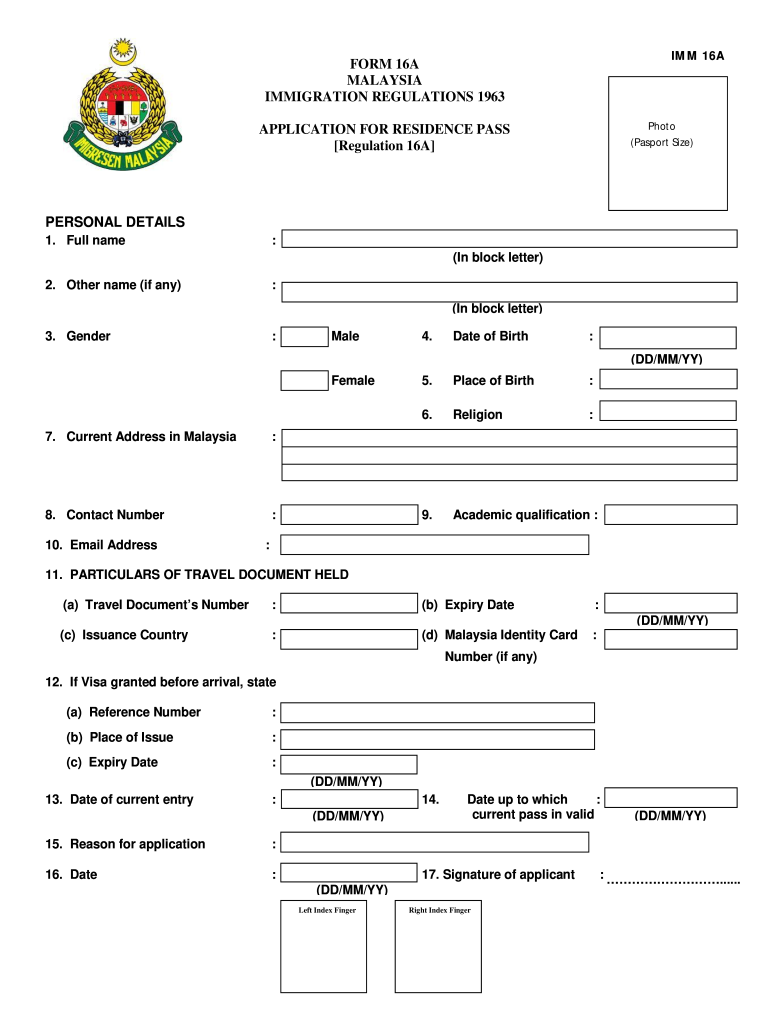

Borang Cp55d Fill Online Printable Fillable Blank Pdffiller

Panduan Mengisi Borang Keberhasilan Pbppp 2016 Pengetua Guru Besar Guru Guru Pendidikan Berhasil

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Borang Permohonan Passport Fill Online Printable Fillable Blank Pdffiller

Borang Tp1 The Lesser Known Tax Relief Form Your Employer Did Not Tell You About

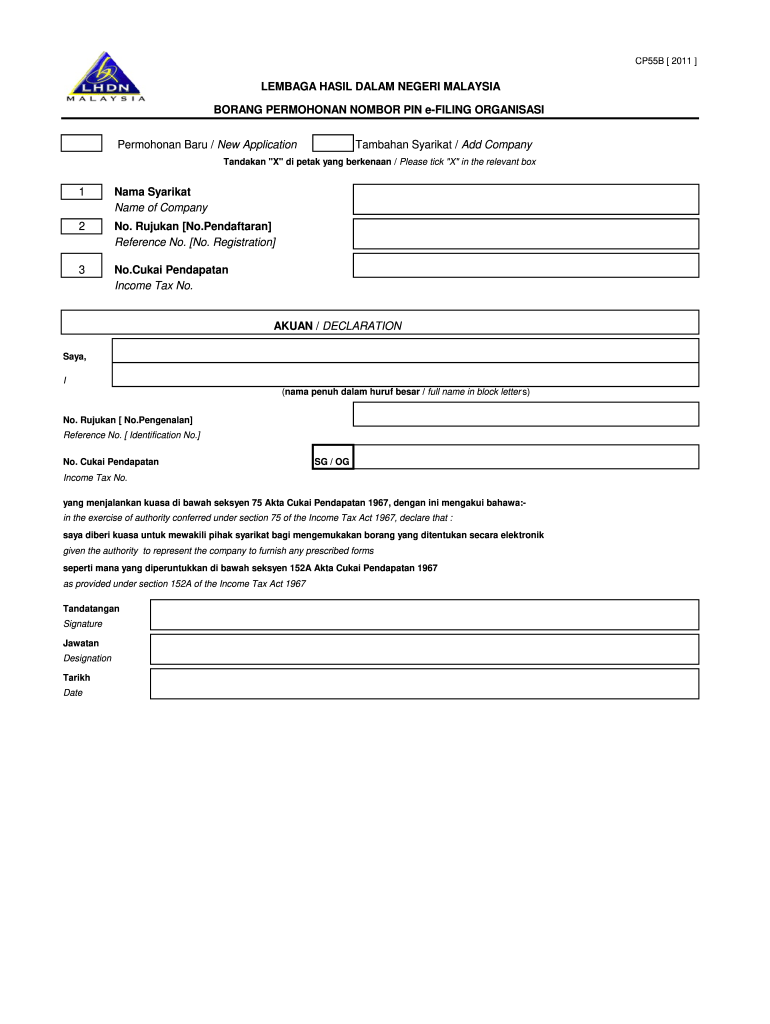

Hr Guide Tax Clearance Letter Form Cp22 And Form Cp22a

Form Cp55d Attached As Per Calcol Management Services Facebook

Borang Tp3 2015 English Version Pdf Employee Benefits Government Finances

How To Step By Step Income Tax E Filing Guide Imoney

Borang Keberhasilan Guru 2022 Pbppp Kpm Reading Comprehension Worksheets Comprehension Worksheets Reading Comprehension

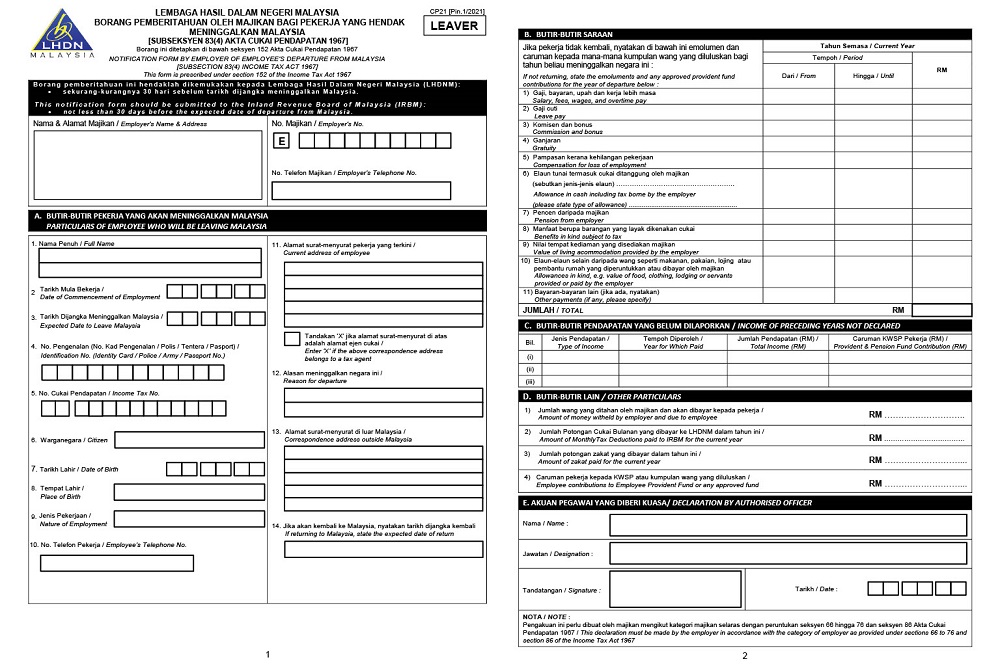

Form Imm 16a Fill Online Printable Fillable Blank Pdffiller

Borang Permohonan Passport Fill Online Printable Fillable Blank Pdffiller

Jabatan Imigresen Malaysia Form Fill Online Printable Fillable Blank Pdffiller

Pin By Wey Taufhan On Car Ferrari F12 Tdf Luxury Cars Toy Car

Permohonan Ke Luar Negara Online Kpm Fill Online Printable Fillable Blank Pdffiller

Universiti Teknologi Malaysia Borang Pengesahan Status Tesis

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News